2023 Ogden Valley Annual Market Update

Author

Brandi Hammon

Published

Jan 24, 2024

Updated

Jan 30, 2024

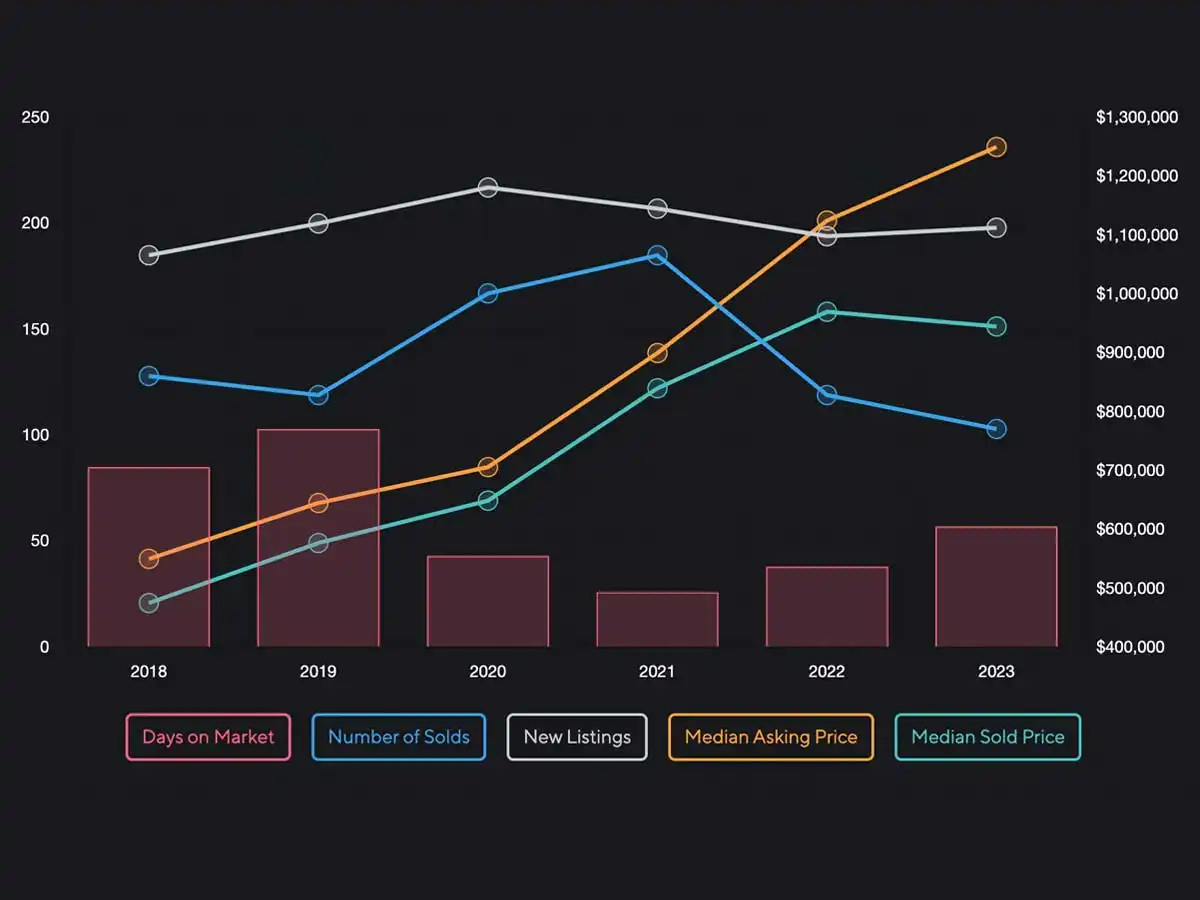

In the real estate industry, the COVID period is defined as a market unmatched in recent memory. It began in March 2020 with the shutdown, amassing an inventory of properties— the kindling. Then came the government stimulus coupled with low interest rates — the spark. Finally, the second home buyer, the Airbnb dream, and 'revenge vacations'— the fuel. Utah’s real estate market ignited and was ablaze through 2022. Almost as quickly as it started, the flames were tempered, to curb inflation, by rising interest rates in March 2022. With the arrival of Ogden Valley's 4th Quarter Market Report, we were able to compare the last six years, and what 2023 demonstrates is a real estate market that has become a controlled burn, but not extinguished.

Single Family Homes

Explore correlations by turning on/off the legend's datasets. Tap on the chart's nodes to see the data points.

Median home values dropped 2.58% from $970,000 in 2022 to $945,000 in 2023 while the asking price rose 11.12% from $1,124,950 to $1,250,000 making the asking price 32.28% higher than the median home value. Solds declined from 119 in 2022 to 103 in 2023, a drop of 13.45%. Inventory grew, as indicated by the 2.06% influx of new listings and a 50% increase of days on market.

Land

Explore correlations by turning on/off the legend's datasets. Tap on the chart's nodes to see the data points.

The land segment saw diverse changes in 2023. The median sold price for land slightly increased by 0.64%, going from $310,000 in 2022 to $311,974 in 2023. Despite this, the new median asking price marginally decreased by 0.11%, from $399,450 to $399,000. The number of lands sold fell significantly—by 31.13%—from 151 in 2022 to 104 in 2023. Additionally, the days on market for land rose dramatically—by 90.70%—from 43 days to 82 days, indicating a slower market. New listings in this segment also decreased by 1.75%, from 286 to 281.

Townhomes

Explore correlations by turning on/off the legend's datasets. Tap on the chart's nodes to see the data points.

In the townhomes sector, there was a noticeable shift in 2023. The median sold price dropped by 23.59%, from $975,000 in 2022 to $745,000 in 2023, while the new median asking price decreased a significant 36.37%, from $1,100,000 to $699,900. Contrarily, the number of townhomes sold increased by 30%, from 10 in 2022 to 13 in 2023. The days on market also increased dramatically—by 1400%—from just 4 days to 60 days. Additionally, new listings in this category rose by 30.77%, from 13 to 17.

Condos

Explore correlations by turning on/off the legend's datasets. Tap on the chart's nodes to see the data points.

For condos, 2023 brought mixed trends. The median sold price saw a modest increase of 2.17%, from $460,000 in 2022 to $470,000 in 2023, and the new median asking price rose by 15.51%, from $484,800 to $560,000. The number of condos sold also increased, albeit slightly, by 9.68%, from 31 in 2022 to 34 in 2023. However, there was a substantial 340% increase in days on market, going from 10 days to 44 days. New listings in the condo market decreased by 25%, from 52 to 39.

In conclusion, the 2023 Annual Ogden Valley Market Update reveals that sellers’ expectations, perhaps influenced by the fiery market of 2021 and 2022, did not align with the actual market. This is indicated by the notable difference between the asking price and the sold price of properties. In 2023, Ogden Valley’s real estate market cooled, moving towards the ‘normal’ of pre-COVID conditions.

Similar Articles

Categories