The True Costs Of Owning A Second Home — Will Your Vacation Property Be Worth It?

Photo: Ski In Ski Out Home at Powder Mountain

Author

Emily Primbs

Published

Sep 20, 2023

Updated

May 20, 2024

Who hasn't dreamed of buying a little slice of paradise after an epic vacation.

Now that the sand is cleared away or the ski gear is back in storage, you've entered research mode. Perhaps you've even narrowed it down to one of the best places for a second home in the west.

You may be wondering — what are the true costs of owning a second home and how do you finance a second home?

Can You Afford A Second Home?

Buying a second home is similar to buying a primary residence, however mortgages, property taxes, and home owners insurance will have different rates and requirements depending on how you plan to use the home.

Second home buyers often underestimate and don't plan for things like repairs, upkeep, home management services, security systems, decor, and furnishings. It's important to know how much to budget for home maintenance.

In this guide, Mountain Luxury will explore the difference between a vacation home and investment property, and demystify the costs of owning a second home- so you can make sure your dream doesn't turn into a nightmare.

Read through to the end and find out the #1 thing we've learned from helping countless clients become second home owners.

Vacation Home Vs. Investment Property — What's The Difference

Are vacation homes and investment properties the same thing?

Vacation Homes

A vacation home is a property you occupy for typically a few weeks or months of the year, and is a specific distance from your primary residence. Lenders may limit the number of days per year you can rent out the property.

Rental Properties

Investment properties are usually occupied by tenants for the majority of the year. However, there is potential for your vacation home to generate rental income and not be considered an investment property if you rent out the property for less than 15 days per year.

You'll likely need some guidance from a tax professional to ensure compliance and maximize any tax benefits associated with your second home.

Top 7 Costs of Owning A Second Home

1. Mortgage

Second home mortgages are traditionally easier to get approved for and the interest rates are usually lower for vacation homes than those for an investment property. Look into the different financing available to you including conventional loans, cash-out refinances, and home equity loans.

Typically a down payment will be higher for a rental property compared to a vacation home, often ranging from 20-30%, as they are seen as riskier due to potential income fluctuations or tenant turnover.

2. Homeowners Insurance

The location of your second home matters, especially with certain areas that may have higher risk factors, such as exposure to natural disasters.

You may need a landlord policy if you plan on renting out the property, or unoccupied home insurance to protect against the risks associated with homes that are left vacant for extended periods.

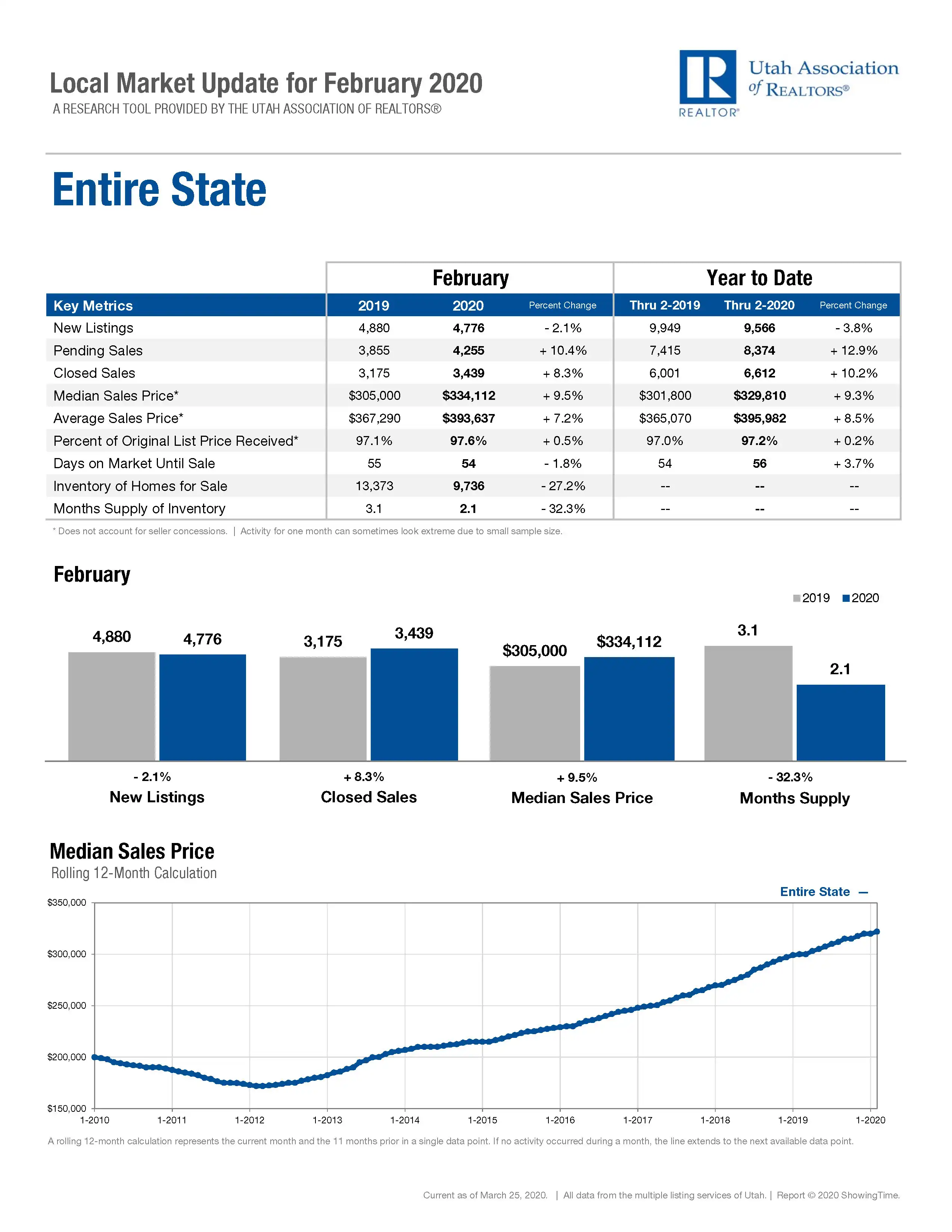

3. Property Taxes

Prepare to pay property taxes on your vacation home. However, if you do not plan on renting it out, the interest on the mortgage and property taxes could be fully deductible from your gross income. Many people who own second homes keep them unoccupied when not in personal use.

Your personal tax advisor will be able to answer your questions.

4. Repairs

Your second home will need maintenance just like your primary residence, with the added challenge of the property being some distance away. Experts recommend setting aside 1% of purchase price for repairs and upkeep every year, and that doesn't include the cost of a property management service.

5. Property Management

The peace of mind that your second home is being taken care of even when you're not there, is priceless. A professional property management company can provide second home care like routine maintenance and weekly inspections if the home is unoccupied, and they can help you book and manage guest stays if the home is used as an investment property.

Depending on the state, area, and whether your second home is used for personal use, short-term rentals, or long-term tenants, these services can range from a monthly flat fee, 8-12% of the monthly mortgage or rent, or 15-50% of the rental income per booking.

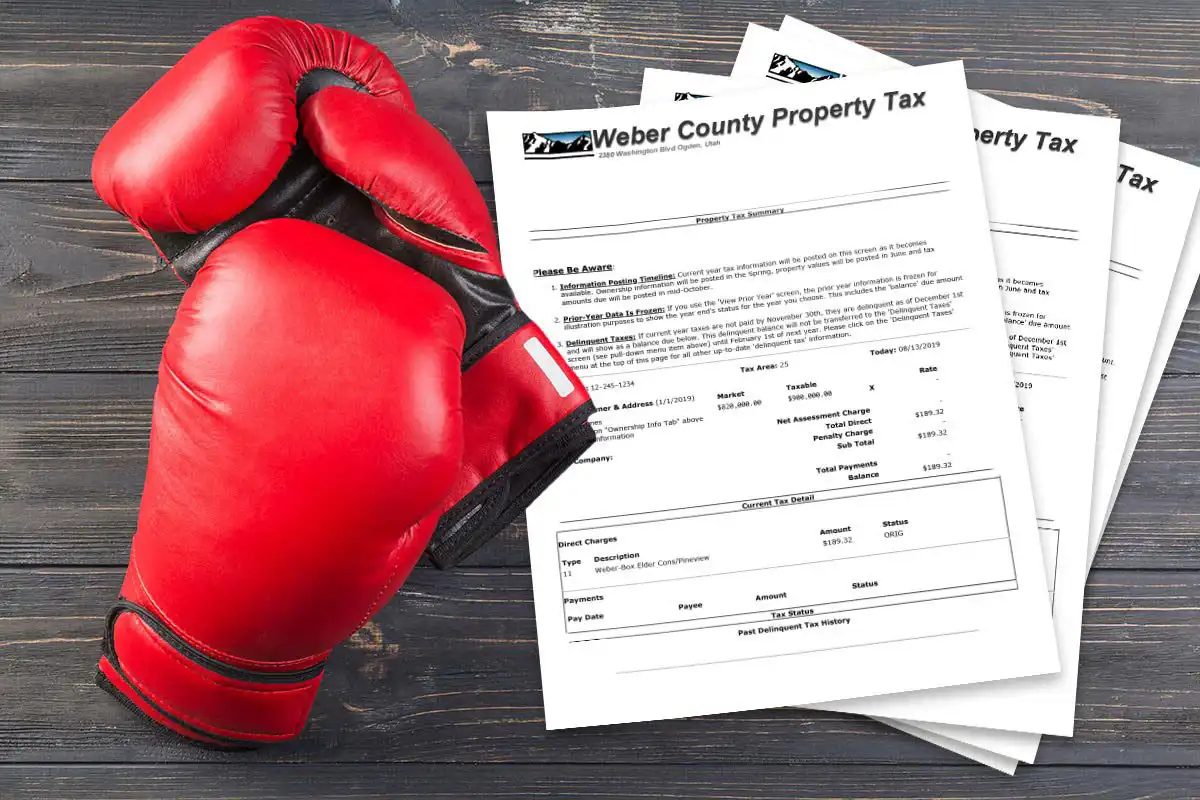

6. Security

Consider installing a monitored alarm system that alerts a security company or law enforcement when the alarm is triggered. This provides additional protection when the home is vacant. Professional monitoring services usually require a monthly fee, which can range from $20-$50 or more. The system itself can cost between $100 to $500 .

Opt for a combination of visible and discreet surveillance cameras with remote access so you can check on the property via smartphone. Plan on budgeting up to $500 per camera and don't forget about the cloud storage or DVR/NVR systems needed for video recording.

Smart locks and lighting automation are other features to include in your security system. These additions can cost anywhere from $100-$300 per lock, and $200 or more for smart lighting switches, plugs, and bulbs.

7. Decor & Furnishings

Many second home owners enjoy the process of styling their vacation home, but for others it's the last expense they think of. That can be a mistake, especially if you plan on offering short-term rentals where a well furnished and welcoming interior can make all the difference in getting bookings.

There are companies and interior design firms that offer turnkey solutions to furnish and decorate your vacation home or rental property. The cost of the furniture packages alone start around $5,000, while large luxury packages can cost $20,000 or more. There will also be consultation, design, delivery, and installation fees to consider.

To manage costs and stay within your budget you may decide to do it yourself. Prioritize which rooms need to be furnished and styled first and which can wait. Shop sales and try mixing and matching old pieces with new ones to achieve a unique, lived-in style.

#1 Tip When Buying A Second Home

Our #1 tip when buying your second home? Work with a real estate expert that has experience with second home, vacation home, rental property, and luxury home markets.

At Mountain Luxury, we specialize in finding the best ski home or vacation home to fit your lifestyle and financial goals.

If you want to know more about how to buy a rental property, we can help you navigate the incredible neighborhoods along the Wasatch Mountains that are zoned for short-term rentals.

Our professional property management services and second home care services ensure you can relax- while you're staying at your vacation home and even when you're not.

Final Thoughts

The current real estate market in Eden, UT and Huntsville, UT has a median listing home price of $1.1M, trending up 2.5% year-over-year. With four season outdoor recreation, awe-inspiring views, and world-class ski resorts, Ogden Valley offers ski in ski out homes that rival destinations like Aspen, CO but without the typical $17M+ price tag.

Explore Eden, UT luxury real estate and discover your second home getaway.

Similar Articles

Categories