How to Appeal Your Tax Assessment

Updated

Published

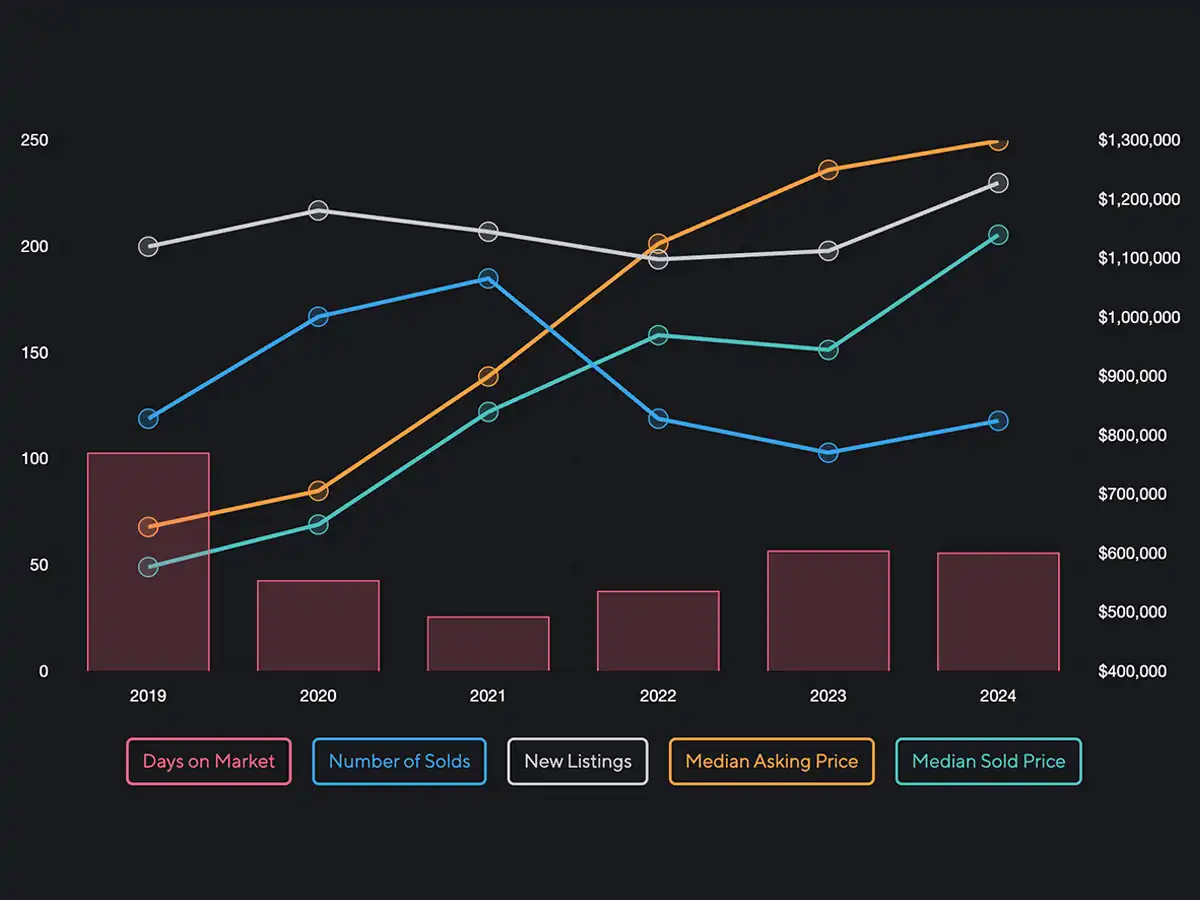

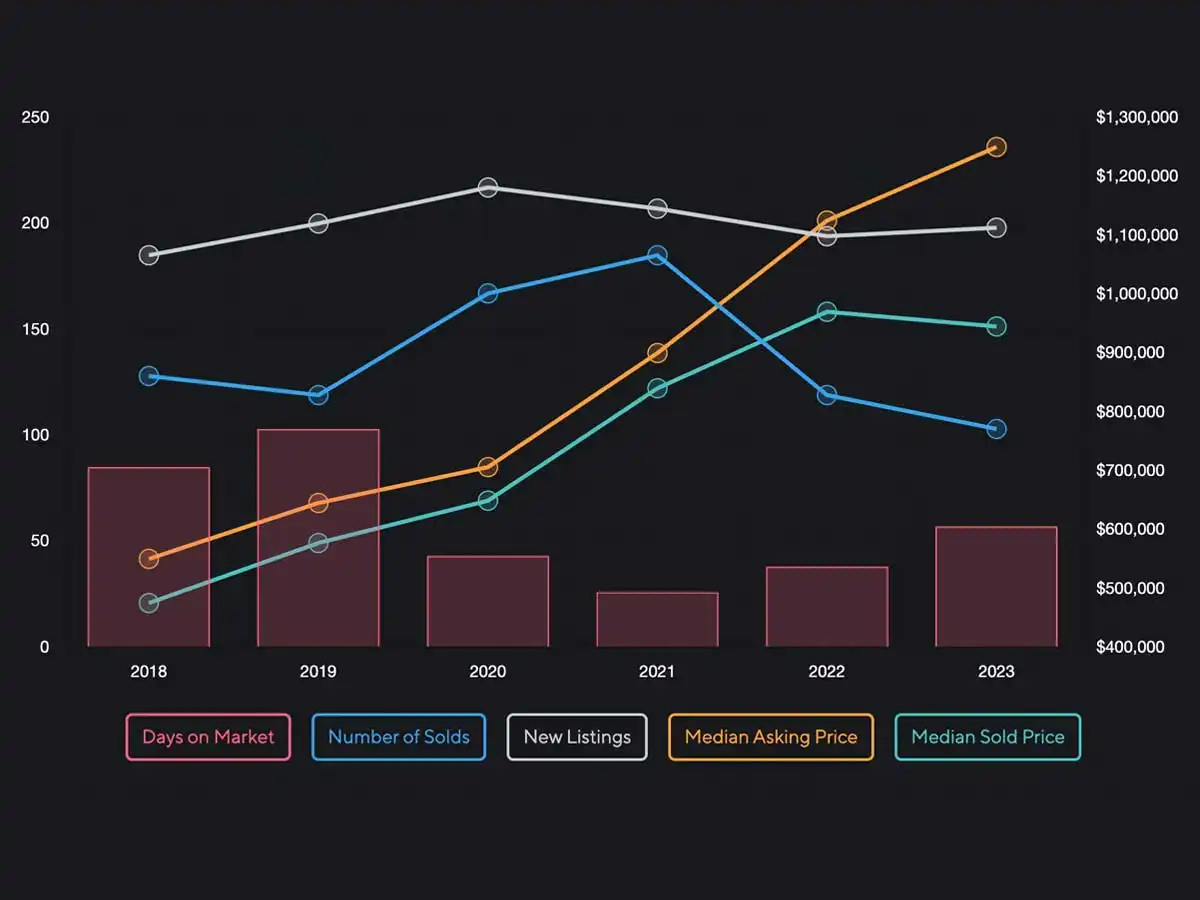

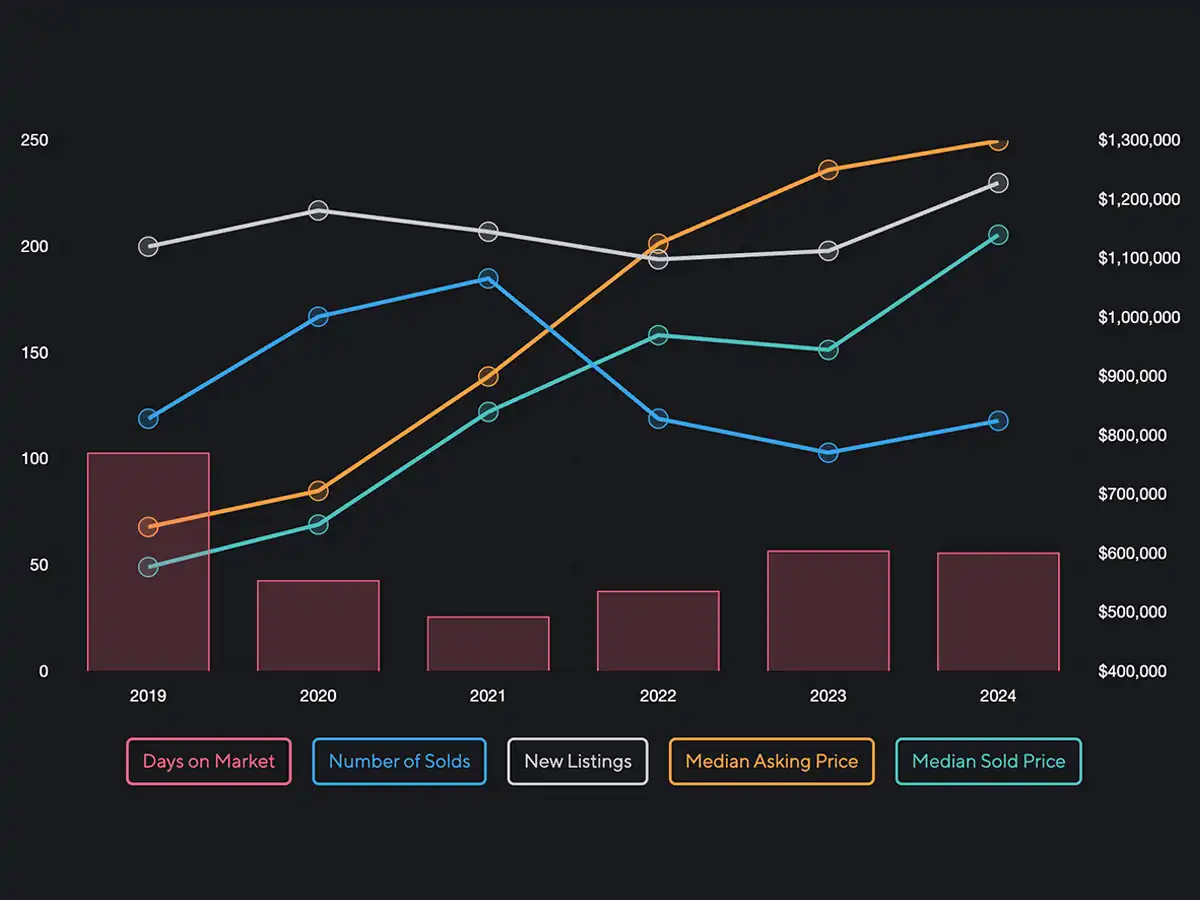

In Weber County, 70-percent of assessment appeals are successful. Here’s what you need to know.

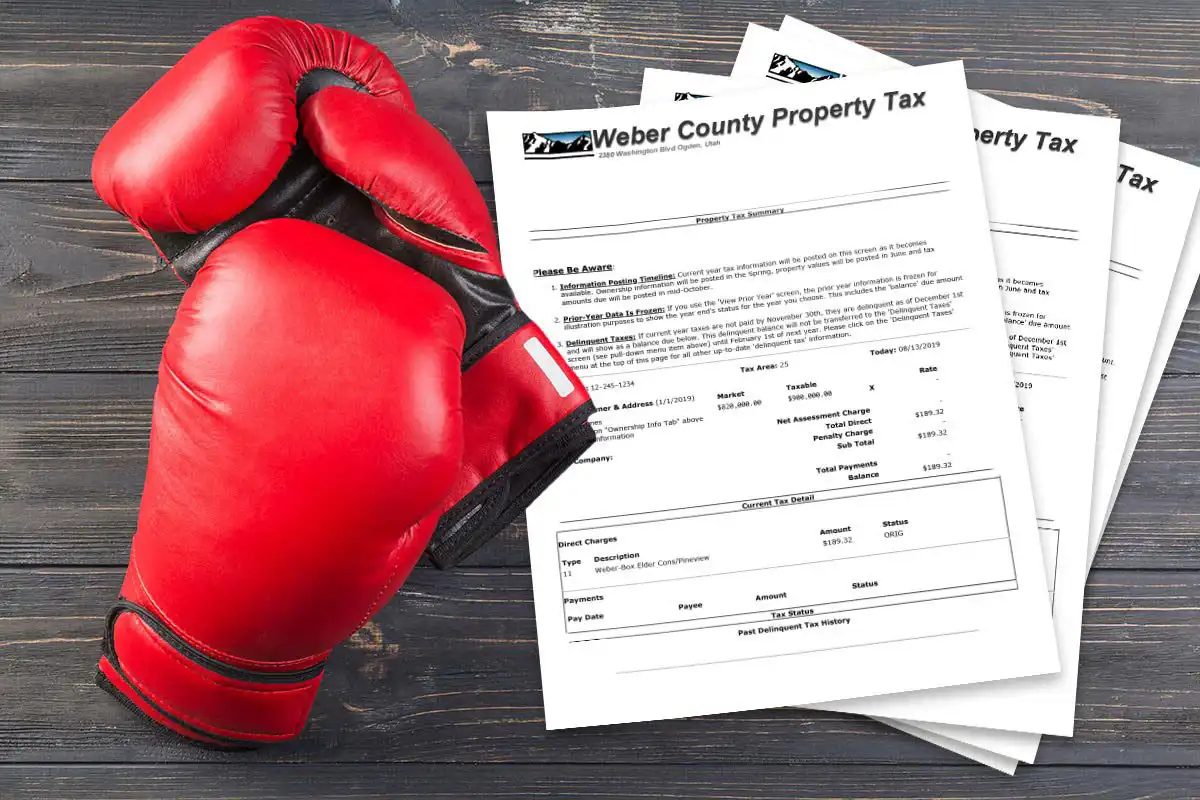

For many homeowners, the day the county property assessment arrives in the mail is a day of reckoning. It’s nice to see that your property investment is going up in value, but if the assessment comes in too high, the new tax bill can be painful. On top of that, there are also many instances in which your assessment may be higher than your property’s true value. This, in turn, will lead to you paying more than your due in taxes.

This isn’t necessarily a case of The Man trying to skim a little extra off of the back of the people. By and large, county assessors try to put a fair value to each property. But accurately assessing the value of tens of thousands of properties each year is a daunting job. According to the Weber County website, there are nearly 90,000 parcels in Weber County, more than 75,000 of which have buildings on them. “Despite our best efforts, sometimes there is an error in the valuation or in our records,” the Weber County Assessor’s office webpage says, “We rely on property owners to help bring errors to our attention through the appeal process.”

There are a number of reasons why your property may be overvalued. The description the county has may be wrong (ie, you have a 3-bedroom house, but are being taxed for 4 bedrooms). You may be eligible for tax relief that you haven’t applied for. Your property may have special issues, such as recent damage from a natural disaster. Or the assessment may simply be wrong, based on other houses in your area.

The bottom line is, errors happen, and not just occasionally. According to the National Taxpayers Union, 30- to 60-percent of homes in the U.S. are overvalued. By the county’s own estimation, 70-percent of appeals in Weber County are successful. Yet Forbes Magazine estimates that only 2-percent of homeowners appeal their assessment.

The NTU provides a simple checklist to help make sure homeowners are prepared for their appeal. Here are a few things you need to know and how they pertain specifically to Weber County:

1) Determine any deadlines or legal requirements for filing the appeal or for claiming any deductions. Comply with the legal requirements and don’t miss these deadlines!

Utah gives homeowners 45 days from the date of the notice, or until September 15, whichever is later, to file an appeal. There are exceptions that allow homeowners to file late, but they are reserved for “severe and significant” circumstances, such as a death in the family or critical medical crisis. The appeal is relatively easy to file, and can be done online. You can also call the Board of Equalization at (801) 399-8400.

2) Make sure all deductions to which you are entitled were granted.

The list of exemptions allowed in Utah is listed on the back of your assessment or online. They include such things as relief for active military who spend 200 days or more on deployment, veterans with a disability, the legally blind, or indigent. You can also call the county with questions: 801-399-8400

3) Check the accuracy of the assessor’s math, description of your property, work papers, and record card for your property.

This could be as simple as carefully reading the assessment received in the mail. You can also find your property online.

4) Consult with any experts who might be of assistance.

There are law firms who specialize in property taxes and many will only take a fee if they win your case. However, be sure the amount you will save in taxes is enough to warrant hiring an attorney. You could also pay to have your house reappraised. In many cases, a call to your real estate agent may be the best place to start.

5) Locate at least three comparable properties.

Websites like the MLS can give you an idea of what properties near yours are listed for. However, Utah is a non-disclosure state, so finding actual sales prices is more difficult. Your real estate agent may be able to get more accurate comps.

6) Make adjustments for differences between your property and comparables.

If you live in an older home surrounded by new builds, or have recent storm damage, make sure those factors are reflected in your property value compared to your neighbors.

7) Check your property’s assessment against the assessments of the comparables.

You can search the taxable value of comps through the county parcel search. If you don’t know the parcel number, you can find that through the county’s GIZMO interactive map.

8) If your assessment is unfair, make an informal appeal to the assessor fist. If the assessor doesn’t agree, file your appeal.

It is worth giving the assessors office a call prior to file a formal appeal: 801-399-8572.

9) Attend an appeals board hearing to get a feel for the process.

Call the County Clerk/Auditor’s office to see if there are any upcoming hearings you can attend: 801-399-8112.

10) Prepare a written summary of your case and rehearse your presentation.

The Weber County Assessor’s office provides information to help you build your case, including FAQs on what is considered good evidence and some of the reasons why your appeal may be denied.

Now that you know the ins and outs of appealing your property tax assessment, it's time to take a look at other real estate in the area. Check out Huntsville Homes for Sale, Ogden Real Estate, North Ogden Homes for Sale, or Eden, UT Homes for Sale.

Further links for appealing your tax assessment:

Similar Articles