Ogden Valley’s resilience and recovery over the last few years has been exceptional, and it is our view that the valley will continue to see higher than average appreciation in home values. Growing popularity of the valley’s three ski resorts, notably Powder Mountain, is creating a lot of exposure, sharing this recreational playground with the world. The limited land available for development, the cap on the number of TDRs (Transferable Development Rights) and the valley’s 3 acre minimum lot size creates scarcity for homes, acting as hole-and-corner factors that elevate home values. Consequently, the valley is especially sensitive to demand fluctuation as supply reaches its longer term limits, which will probably be good for values in the long run.

Recent Price History

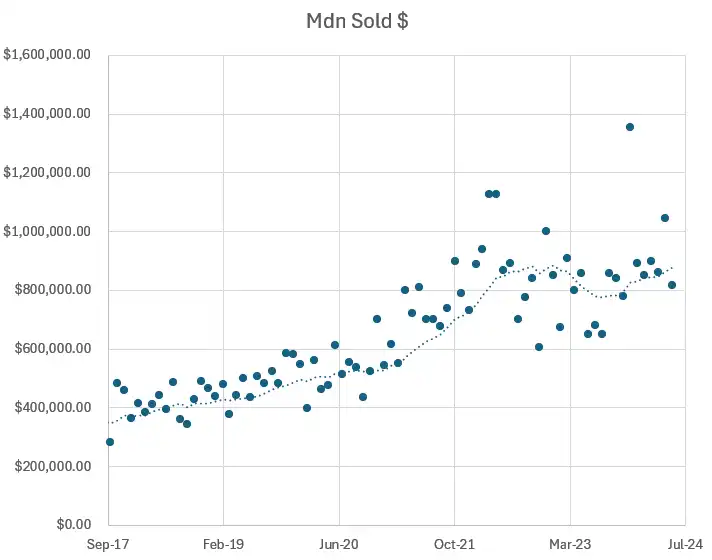

Median home values at the start of 2020 sat around $500,000 on a 12-month moving average following an impressive 40% gain in equity from 2017-2020. During the covid boom, values jumped again from $500,000 in 2020 to $900,000 in 2022 – an 80% gain in equity in just two years. Over the same period, the S&P 500 gained just 27%.

Rising mortgage rates in 2022 brought the “pandemic party” to an abrupt halt, first stalling prices in the valley then dragging them down from $900,000 to $775,000 in 2023 – a 17% decline or a 25% reduction of value gained since 2020. Since then, prices have remarkably recovered back to their 2022 highs.

Market Environment

However, even though prices are the same as they were in 2020, our little housing market has stark differences:

- Mortgage rates today are at 7% Vs 2020’s 2.3%.

- STR (Short Term Rental) profit margins are low.

- Buyers have a slight advantage in transactions.

- A larger share of high income demographics.

The biggest influence on real estate as a whole has been the overnight rate set by the Federal Reserve. The Fed first raised rates in March of 2022 to fight a looming 7% inflation rate. Their efforts have been largely fruitful, reducing inflation to a mere 2.7%, close to their 2% goal. That achievement, however, comes with a cost – a 5.5% overnight rate. The long and short is that rising Fed rates heavily influence yields on bonds, which include mortgage bonds. Thus, the 30-year mortgage rate has been in the 7%-8% range for almost a year now.

The higher income demographic in our market will be largely unaffected by rates. Million plus dollar homes have a tendency to sell in just about any market that isn’t in crisis. These buyers make up a presumably large fraction of the demand in the valley considering home values continue to rise despite high rates. However, sales numbers clearly show that demand is falling.

Buyers who rely on financing for purchases have been extremely impacted by rates. What once would have cost a buyer $2,000 per month for a $400,000 home now costs $3,100 (50% higher). In higher value markets, those costs are amplified by purchase prices. STR properties have been especially impacted by rates. Trendy investment properties suddenly became unprofitable after high-rate loans and falling cap rates relative to prices. In short, the number of buyers financing their purchases have been scraped from overall demand.

High income buyers are more likely to seek out the most “desirable” properties, keeping home values in the valley high. The time on market for homes is half that of the historic average – 50 days vs 100 – but also on trend with the historic trajectory.

The valley is unique in that properties are valued more by qualitative factors than quantitative. This is a characteristic of real estate in general, but is emphasized in the valley. Properties with desirable characteristics, like views, aesthetic, individuality, etc., tend to sell exceptionally when compared to counterparts with similar, but slightly less desirable characteristics.

This logic forges a criteria of “desirability” for certain properties. The more criterion a property can check, the more valuable it is. In other words, values for properties can vary widely based on this, and so can demand. Traffic for less desirable properties will be low when priced to meet that of their more desirable counterparts. Properties that fit the desirable criteria drive prices in neighborhoods and the most traffic. Less desirable properties will still sell at reasonable prices, but must be less than the highest comparables. This is how we at ML see the market today, and presume it’s what keeps prices elevated.

The 12 month absorption rate is 14.5%, indicating a slight buyers market. This is also reflected in the Sold to Original List price ratio of 95%, where homes in the valley are selling for 5% less than their original list prices.

Development

Development in the valley is stalling, although rates affect developers less than traditional buyers. Private equity investment in real estate helps to eliminate interest costs. Development timelines also tend to stretch past current market conditions and call for speculation on future markets. That said, low demand will still discourage developers from initiating new projects. The limited amount of desirable land in the valley is also a factor that reduces production and profitability.

Here’s the new projects in the valley that we’re keeping our eye on:

- Cobabe Ranch

- Sage

- Harmony Ranch

- Powder Canyon

- Osprey Ranch

- Legacy Mountain

- The Basin

- The Bridges

- The Ridge

- Gateway Estates

- The Pointe

- Sundown on Powder Mountain

- Aspen Ridge

- Harbor View

- Crimson Ridge

- Eden Crossing

- Other unnamed/speculative projects

Building costs in the valley continue to be high. It costs builders about $400 per square foot when using vendors. Builders can lower that cost by bringing some 3rd party services in-house. Hiring a builder puts costs at no less than $450 per square foot.

Land

There are more land listings on the market than anything else. Some land, especially in the wolf creek area, is probably undervalued because of underlying water issues. The central risk of land is the cost to build, currently at a minimum $450 per square foot. Only extremely high value areas offer the metrics to justify a return on building.

Buyers seeking properties to build their own home, regardless of return, will seek out the most “desirable” lots, as discussed earlier. Lots with protected view corridors, appropriate orientation, water features, accessibility, and feasibility meet this criteria and will fare better than those that don’t. There could be other factors at play, such as CC&R guidelines and HOAs that protect the value of existing structures and securing the value of future projects.

Overall, somewhat desirable land is in large supply and is relatively cheap compared to the value of the homes that could be built upon them. Properties that check all the boxes, however, are far and few between.

Short Term Rental Dynamics

In the United States, there is a popular trend of buying and renting real estate as investments. The valley is no exception to that. Many buyers looking in the valley are targeting STR areas, which includes the greater part of Wolf Creek communities. The number of transactions in 2020 compared to the number of migrants (219 and 222, respectively – 2021) is a clear indication that the number of primary residents joining the community is presumably a fraction of the valley’s demand. The rest can be attributed to second-home and STR seekers. Long term rentals are allowed across the valley, but STRs are only allowed in specifically zoned areas.

The profitability of STRs is questionable at best. Equity trajectory is not promising, and largely relies on mortgage rates. The demographic of buyers of STRs take out mortgages and take the difference between the rent and mortgage as their margin. When rates are high, that margin diminishes. Conversely, when rates are low, that margin grows. In the recent market environment, you could expect cap rates (annual return) as high as 5% and a gain in equity after property tax, rental fees, and maintenance costs. Now that rate is around 2.5% at best with a risk of declining equity in a high rate environment. Once you incorporate a 7% mortgage on even just a fraction of the purchase, you would be lucky if your investment covered its costs.

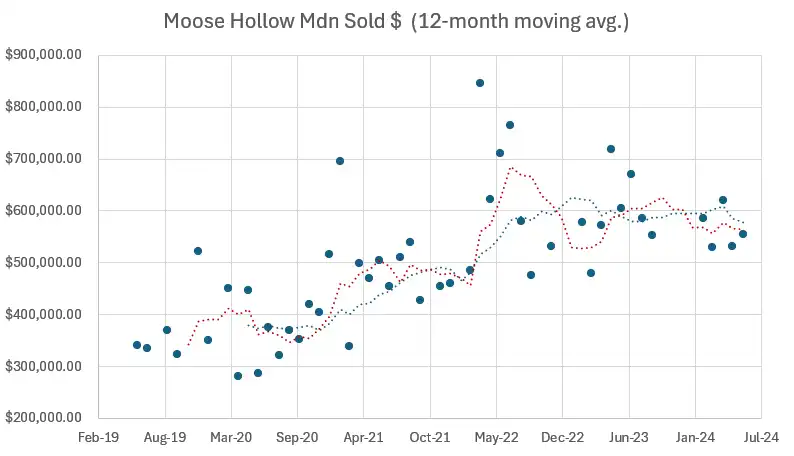

For example, Moose Hollow, a center for nightly rentals, saw median values fall on a 6-month moving average (red line) from $670,000 to $530,000 – a 21% decline. On a 12-month moving average, growth completely stalled in 2022 and is in a slight decline (blue line).

In short, as long as mortgage rates remain high, STR profitability and demand will remain low.

Ogden Valley Market Outlook

Property values in the valley have recovered extremely well following last year’s price declines, and appear to be rising. Similarly, the rise of prices from 2020 in the valley are nearly double state prices, 90% and 50%, respectively. Reasons for this could include solely or a combination of:

- Increased exposure.

- This would seem to come from multi-resort pass pass programs, like the Epic pass. The valley has three ski resorts and a lake between them all, a strong incentive to look into moving here.

- In-migration.

- Out of state incomes purchasing second homes or primary residences.

- Higher migration rates would increase the share of buyer traffic in the valley.

- Investment.

- There have been historically high levels of investment in the valley since 2020.

- The recent purchase of Powder Mountain is bringing Jobs and high income individuals to the valley.

- Continued development efforts and opportunities in private equity real estate.

- Efforts to rezone areas to permit STRs, increasing the perceived value of those areas.

Many current developments continue to make headway, albeit slowly. Supply chain constraints have been eased, but construction prices remain inflated, leaving profitability to private investors with in-house construction management teams and large subdividable land opportunities. Spec homes are only profitable in select high end areas. Nightly rental profitability is scant relative to a combination of prices, rates, service costs, and taxes, beating out many investors looking to finance a purchase.

What does this mean for you?

For those looking to buy in Ogden Valley, buying a quality home is a no-brainer. Your equity is safe, and long term gains are promising. In the three years prior to the pandemic, median home values increased 13% per year from 2017-2020. It’s safe to say we’ll probably see no less than the state’s 7% average Year over Year equity growth since 2013. With that said, it’s important to not be blinded by historic numbers. This is no “get-rich-quick” scheme; this is your safe, long-term investment. History does not always repeat itself, and there’s no telling what the future holds.

And for sellers, your decision to sell should be circumstantial. For the reasons listed above, your purchase will be safe for years to come. If this is an investment, you should do the math: Check what the valley’s average gain in equity is and match that against your value and ownership costs, which may include second home care, taxes, utilities, and more. Make a plan with your financial advisor to keep your investment safe. If you eventually want to sell, remember to maintain your home. It’s always better to take care of pressing issues before it’s time to list. This will help you limit an alarmingly real depreciation cost.

Call 801.745.8400 for our expert real estate insights or to schedule an appointment with one of our top-performing realtors. Our team provides comprehensive listing coordination, including repairs, cleaning, marketing, and more. As a buyer with Mountain Luxury, you'll gain access to exclusive information before it hits the market, giving you the competitive edge to secure the best deals. Discover more about our company and vision here.