Utah Real Estate Bubble Popped. Did You Miss It?

Author

Kylar Vierra

Published

Aug 1, 2024

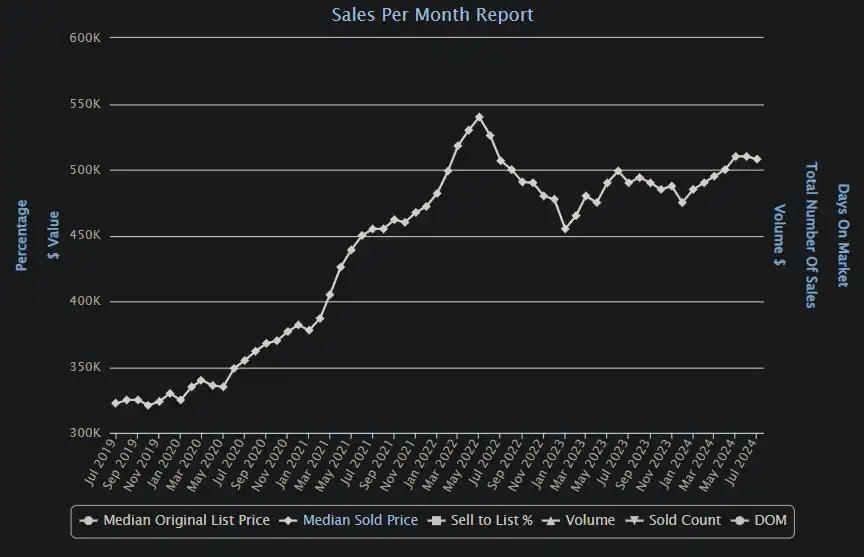

Real Estate market phenomena are major internal topics of interest here at Mountain Luxury. As such, we continue to analyze and reevaluate our stances. At the end of 2022, it was well understood that prices were falling, and would have to bottom out around May 2023. Our internal office gamble was that prices would fall at most 15% year over year, but reality differed with the biggest loss being in April 2023 at -11.5%. However, the peak to trough decline measured -16% from May 2022 to January 2023 – in just eight months – slightly exceeding our year over year estimate.

This unprecedented rise from January 2020 to March 2022 totaled 66%, followed by a swift scrub of 26% of those gains, then finding solace in the following 18 months, locking in a total 55% median home value gain from 2020 to the time of writing this article. This brief example implies, almost glaringly, that a bubble has popped, and that the remaining creation value is a combination of inflation and increased demand.

Inflation is Sticky

This is the term that best describes our recent price history. It’s shocking how price surges in the market align with fiscal policy spending. In March 2020, the CARES Act, a $2.3 trillion relief package, aimed to stimulate the economy in the wake of Covid, but what’s important to us is its correlation with Utah’s median home prices. In the two months following the initiation, prices jumped 4% in June 2020, followed by an unprecedented 1.5% monthly increase in values through December 2020, ignoring seasonal trends. In December 2020, another $900 billion was approved through the Consolidated Appropriations Act. Where prices fell 1 percent in January 2021, they jumped another 4.7% in the next two months. In March 2021, congress passed another $1.9 trillion relief package – the American Rescue Plan Act. Following its initiation, home prices in Utah accelerated upwards to $472k – a 45% increase – before fiscal policies began to be discontinued in 2022. All the while, mortgage rates hit an all-time low of 2.3%, making the cost of money cheaper than ever.

If that’s confusing, let’s boil it down: The U.S. government’s attempt to counteract the pandemic infused our economy with “printed” money. Some of that money found its way into Utah, driving up prices at rates never seen before.

Bubbling Up

At the start of 2022, the Federal Reserve (Fed) began tightening their grip on inflation. Median home prices didn’t stop rising as mortgage rates jumped as high as 6% in early 2022 and fiscal policies were being discontinued. Prices would rise another 14% before peaking in May 2022 – a cumulative 66% gain in value since the start of 2020.

*POP*

26% of those gains were wiped out in just eight months from $540k in May 2022 to $455k in January 2023 totaling a 40% gain since January 2020. The total decline from peak to trough totaled -16%. For reference, the fastest decline the recession saw over the same period was -12%.

The New Norm

However, this growth is still substantial, especially for real estate. This strong correction has set the foundation for surprisingly robust demand despite 7% mortgage rates. Since bottoming out, prices have rebounded to $510k without a tendency to stray far, solidifying 55% growth since the start of 2020. Such a composed recovery suggests today's prices are sticking around.

The Utah housing market is currently exiting its recessionary phase and is in the process returning to its historical performance. Sales numbers suggest that buyers are beginning to absorb the increase in inventory witnessed over the course of 2023. It seems that buyers and sellers have struck a balance, making visions of the future bright.

Call 801.745.8400 for our expert real estate insights or to schedule an appointment with one of our top-performing realtors. Our team provides comprehensive listing coordination, including repairs, cleaning, marketing, and more. As a buyer with Mountain Luxury, you'll gain access to exclusive information before it hits the market, giving you the competitive edge to secure the best deals. Discover more about our company and vision here.

Similar Articles

Categories

Sorry, nothing matches that search.